when are property taxes due in illinois 2019

Residents wanting information about anything related to property taxes or fees paid to the county can click through the links. Corporate purposes general fund including amounts for fire protection ambulance services and imrf.

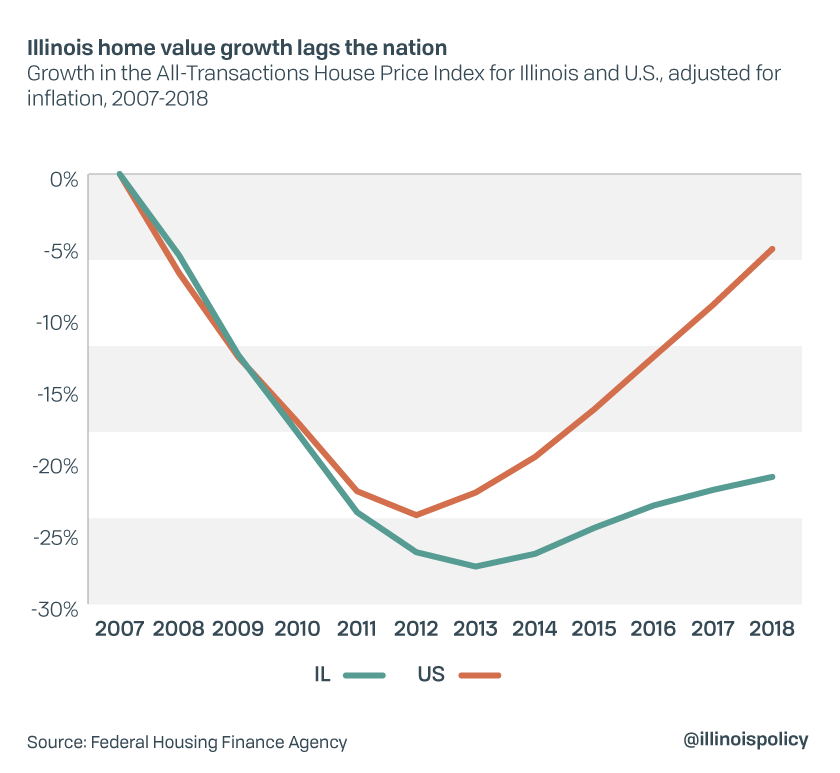

Illinois Home Values Down 21 Property Taxes Up 9 Since 2007

Tax amount varies by county.

. Illinois is not extending the filing or payment due dates for tax year 2019 returns for partnerships including nonresident withholding Form IL-1065 which still falls on April 15. It is managed by the local governments including cities counties and taxing districts. Yes to did you own your primary residence.

Voter Election Info. Due dates are June 6 and Sept. For now the September 1 deadline for the second installment of property taxes will remain unchanged.

The Illinois Department of Revenue does not administer property tax. The typical homeowner in illinois pays 4527 annually in. Property tax due dates for 2019 taxes payable in 2020.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. NYC property tax could be paid quarterly if the home value exceeds 250000 or semi-annually. The deadline for each quarterly instalment is July 1 October 1 January 1 and.

The Second Installment of 2020 taxes is due August 2 2021 with application of late. Your real estate tax deduction for 2020 2019 taxes in Illinois are billed in 2020 is what you paid. Physical Address 18 N County Street Waukegan IL 60085.

The Official Government Website of Macon County Illinois Search for. 2019 payable 2020 tax bills are. April 12 2021 1140 AM.

The mailing of the bills is dependent on the completion of data by other local. Are Illinois property taxes extended. Tax Year 2021 Second Installment Property Tax Due Date.

Has yet to be determined. 173 of home value.

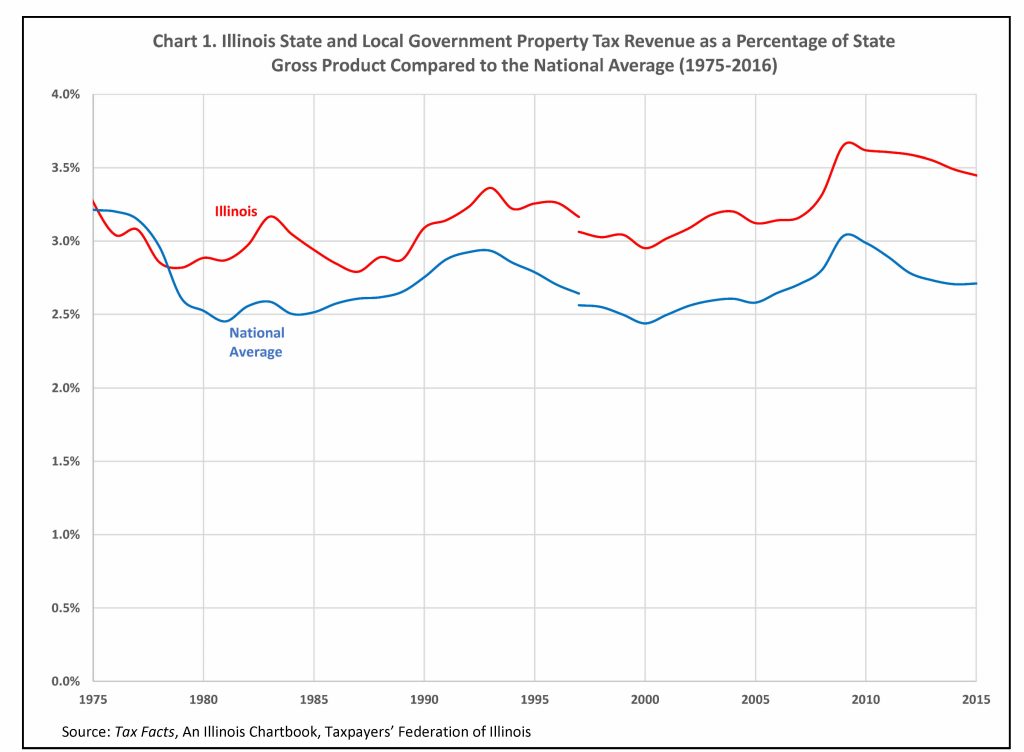

Taxpayers Federation Of Illinois A New Property Tax Relief Tax Force Same Old Problems Mike Klemens

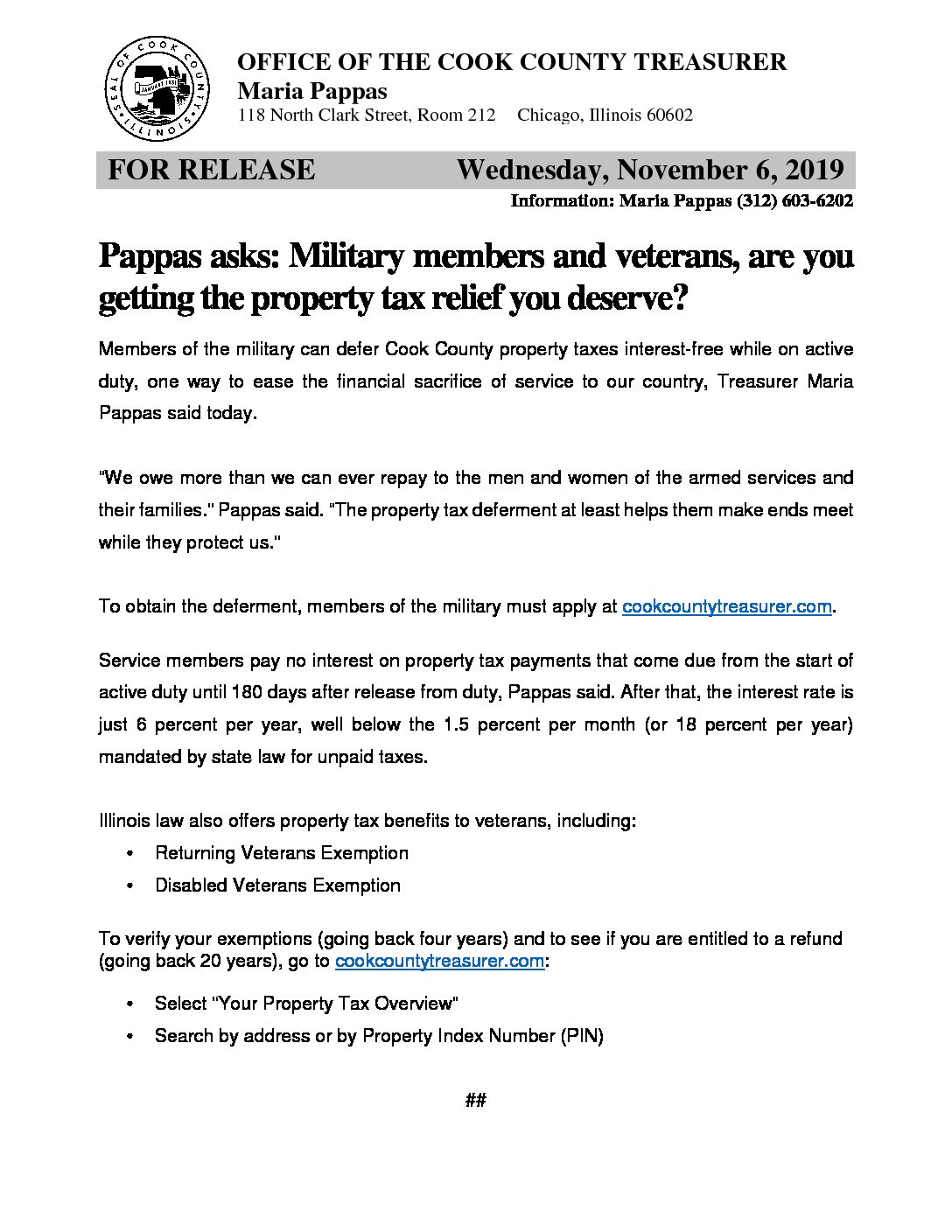

Property Tax Relief For Military Members State Representative Debbie Meyers Martin

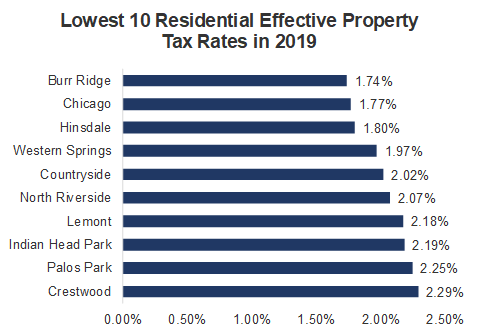

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

State Corporate Income Tax Rates And Brackets For 2019

2022 Property Taxes By State Report Propertyshark

University Of Illinois Urbana Champaign Reveals Funding Schools Would Relieve Property Taxes

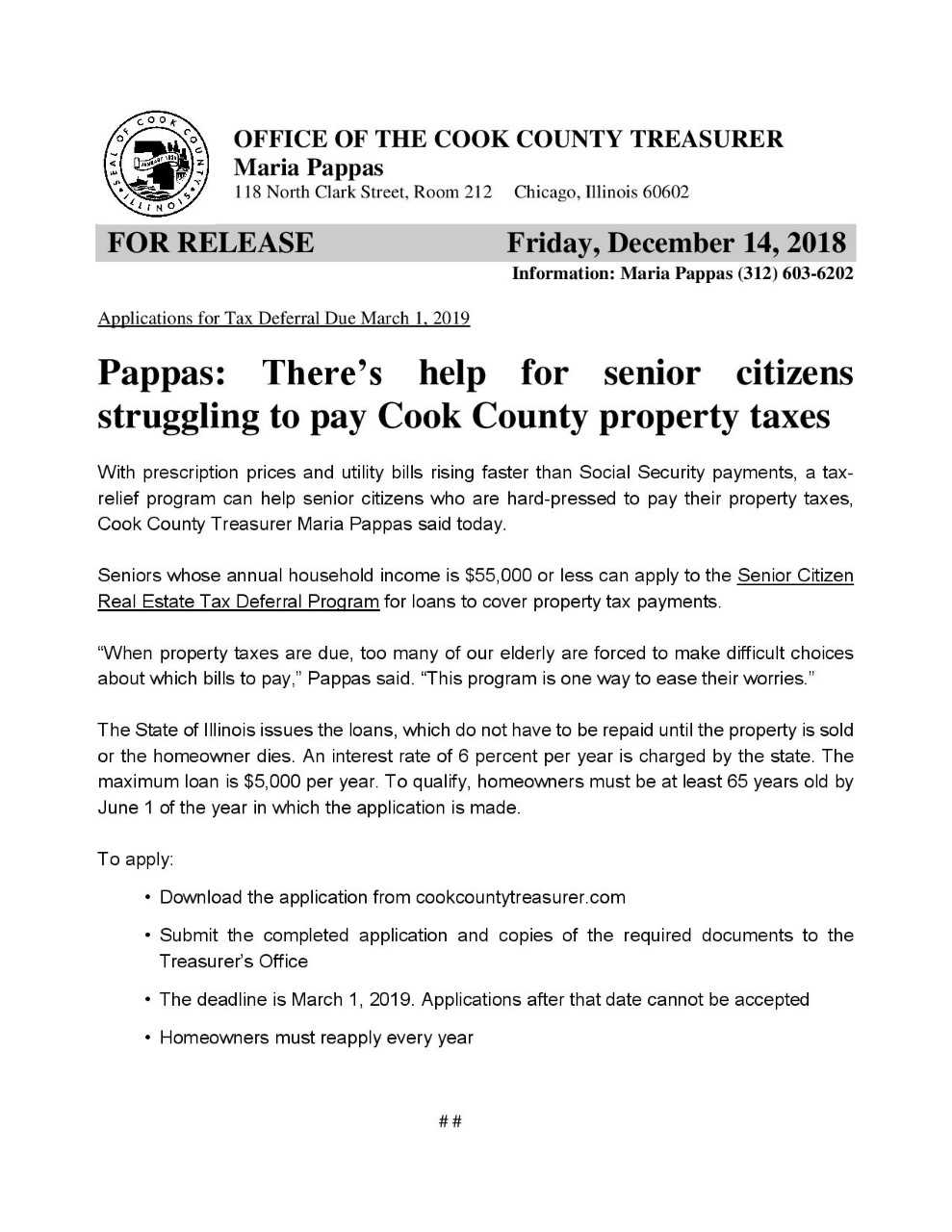

Cook County Senior Citizen Property Tax Deferral Alderman Tom Tunney 44th Ward Chicago

Dupage County Residents Pay Some Of The Nation S Highest Property Tax Rates

Tax Information Village Of River Forest

There S Help For Senior Citizens Struggling To Pay Cook County Property Taxes Building A Better 7th Together

Illinois Rising Property Taxes Driven By 75 Billion Local Pension Debt Madison St Clair Record

Illinois Pritzker Promised To Lower Property Taxes He S Only Made Them Worse Wirepoints Wirepoints

Property Taxes By County Interactive Map Tax Foundation

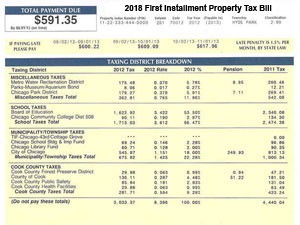

Cook County Property Taxes First Installment Coming Due Kensington

The Cook County Property Tax System Cook County Assessor S Office

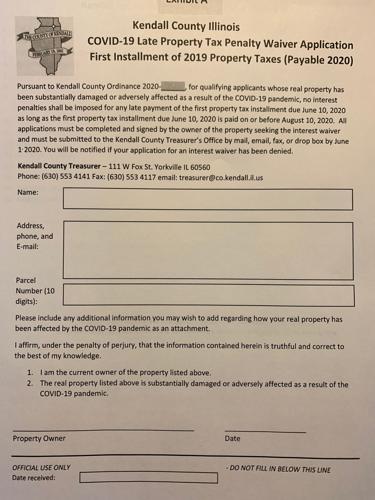

Kendall County Board Votes To Postpone Interest Penalties On 1st Installment Of Property Taxes Local News Wspynews Com

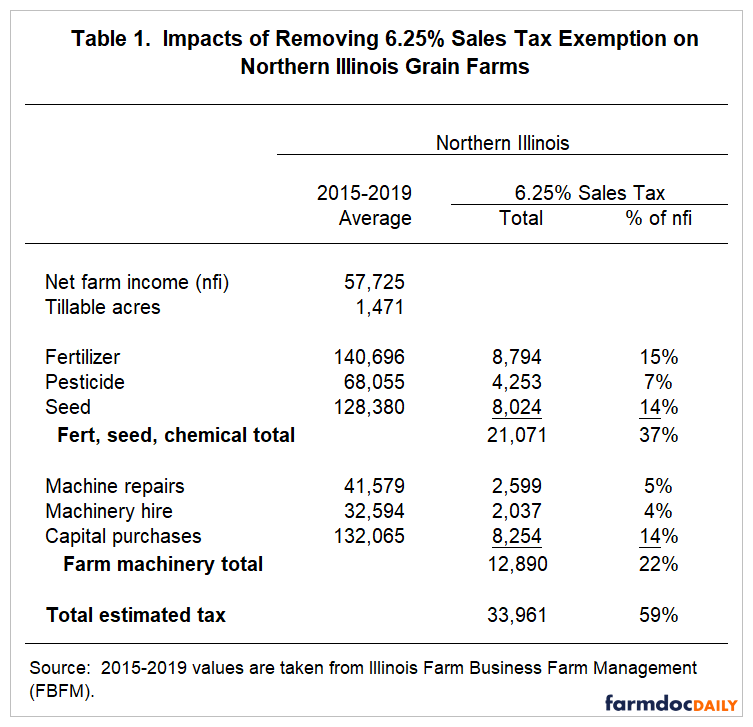

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

Impacts Of Removal Of Illinois Sales Tax Exemptions On Illinois Grain Farms Farmdoc Daily